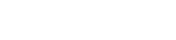

In simple words, cash flow is the movement of money coming into your company and going out of it. But, knowing only this is not sufficient, unless you know the importance of cash flow and its proper management.

The importance of cash flow can be ideated with its definition, also given above: it is the movement of money or cash coming in or going out of your business. The better control you have over the cash flow management, the more and the longer you can hold money in your business.

Cash or money is the most valuable asset to run your business. Without it, your business life will come to an end.

There is a small collection of stats acquainting you with the importance of cash flow:

- 68.9% of businessmen are afraid of losing their business owing to the lack of available cash.

- 37.5% of business CEOs found cash flow management as the ultimate challenge in running their companies.

- According to research firm CB Insights, 29% of startups face failure due to cash issues.

- As per a US bank study, poor cash flow management led to the failure of 82% of businesses.

- Some stats show that 60% of businesses going bankrupt are profitable, but they ran out of cash.

Not having a sufficient amount of cash means you’d better consider your company ramshackle. With money, you pay your company electricity bills, employees, buy machines and equipment, invest to make profits, and take risks to render your business thriving, and so on.

So, let’s know cash flow importance and tips to manage it one by one for a confusion-free interpretation.

Highlights of Contents

Why is Cash Flow Important for Your Business?

Facilitating the sustenance of business:

Being financially stable, you will be able to pay your payees and deal with day-to-day expenses like paying your employees, bills and rent, your vendors, and so on conveniently.

All of them have their own roles in running your business. Being paid by you on time will keep them satisfied and fulfilled, easing extracting 100% of them.

When your employees work well, your vendors deliver you everything you need on time, you don’t have issues over electricity or rent payment, and you can deal with some other expenses coming suddenly, the sustenance of your business will be no more than a walk in the park for you.

Cash Flow Helps You Grow Your Business

It tends to happen that many golden opportunities are easily available in the market. Having a hefty amount of money can help you take advantage of such golden chances.

By investing some amount of money, you can make a handsome profit in such situations. Here, not only you will grow your business by having more revenue, but you can also secure your company’s future.

Let’s take an example for your better understanding:

If a restaurant introduces a foreign or regional cuisine to a particular group of people, and they like it, the restaurant owner will be required to hire more employees to cook the cuisine, serve customers, make bills, order more inventory, set chairs and tables, clean the restaurant, and so on.

If the owner runs out of money, then they won’t be able to do all this, which will not only spoil their reputation in the market, but it will also leave their customers angry and not ready to come again to them, leading to the closure of their business permanently.

On the other hand, if they have a huge amount of cash, then grabbing this opportunity will be much easier for them, facilitating their business growth.

Paying Your Employees and Vendors on Time

The role of employees and vendors for your business is something you mustn’t be unfamiliar with. If they are miffed with late payments, then they can leave you and move somewhere else and will not work for you investing their all-out dedication.

Paying them on time will make them take your company and the tasks assigned to them more seriously. Being paid regularly will also prevent them from looking for another job or clients.

All this can be made possible if you always have a sufficient amount of cash in your account. So, proper cash flow management is also important to render you eligible to pay your vendors and employees on time, thus having more loyal vendors and employees.

Allow You to Take Risks

To grow and sustain your business, you have to be in quest of those ways leading to a handsome profit. But, opportunities don’t knock at your door on its own every time.

Sometimes, you have to create them and take risks. When you have money in bulk, then you can explore your industry, know your clients or customers better using new methods, have an idea of your competitors’ weaknesses and strengths, invest in advanced technology, and so on with that money.

Doing so, you will take risks after considering all factors, thus your chances of failure will be almost none.

Moreover, If you hit the bull’s eye, then the growth and sustainability will not be a dream anymore, as everything will turn into reality.

Taking Loans Not A Headache Anymore

What a bank sees before approving a loan?

The bank sees the transaction record of a person or businessman over a long period of time with an eagle eye. After that, your present financial condition gives it an idea of their ability to repay a loan.

Having a healthy cash flow means a handsome amount of money always available in your account for a long time, which means you are financially capable of repaying a loan.

So, taking loans from a bank or any other financial institution will not be a headache for you.

Fill Your Business Mind with Confidence

Due to lack of money, many businessmen are preoccupied with the ways to arrange some money to sustain their business. It consumes a great deal of their time, energy, money, and sometimes, fill their minds with negativity when coming across failures back to back.

Your story will be quite different, as having cash available will allow you to think more innovatively, invest after a proper assessment, hire more eligible employees, buy more advanced technology-powered machines, and so on.

Being capable of doing all these things mean that your business mind is filled with the utmost confidence.

Now, Let’s Know How to Manage Your Business Cash Flow:

Adopt Advanced Cash Flow Management Software

Investing in an advanced cash flow software system is a considerable step to manage accounts payable and receivable wisely.

Invoicera, one of the most renowned invoicing systems for an ideal cash flow, allows its users to manage their vendors and clients in the same dashboard.

Moreover, it sends out every single document in a timely manner with automatic reminders, which makes your clients pay you regularly, resulting in an appropriate cash flow and smooth small business billing in your company.

Manage Accounts Payable and Receivable Wisely

Only having cutting-edge software doesn’t mean that your responsibility is fulfilled. There are many things that only humans can do.

Whenever you find your business cash flow going down, arrange a meeting, pick out the reasons, ask every member to give a suggestion or advice, contact experts, and the like to get all under control.

Doing all this, it will be much easier for you to manage your accounts payable and receivable wisely.

Control Your Business Expenses with Expense Management Software

Do you spend more than you should to run your business?

Don’t be ashamed, it’s not only you, in fact, but there are also innumerable businessmen who suffer from this nuisance.

The only and finest way to ward off this issue is the adoption of modern billing software coming with features like expense management, staff management, client management, and the like.

Such software solutions will alert you when your expenses get out of control, thus giving you an exact idea how much to spend on a task or project for the proper cash flow management.

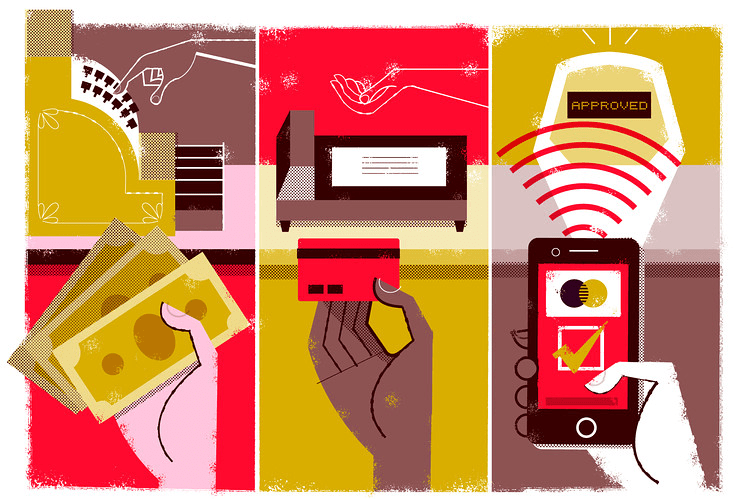

Make Easier for Your Clients to Pay You

The easier will be for your clients to pay you, the more and quicker they will pay you, leading to a healthy cash flow.

Allow your clients to pay you with more payment gateways. They can choose one as per their convenience and choice to pay you.

Furthermore, instead of asking for payments in one go, make possible for them to pay you 80 to 90% of a project fee, and the rest will be paid with the next project, especially to the clients having financial issues.

Moreover, discounts and offers can fill them with energy to take advantage of an opportunity to pay you.

So, embrace all these methods to facilitate their payment, giving birth to your ideal cash flow.

Reward Clients when Receiving Payments

Many clients of yours must be regular and punctual in payment. You’d better reward such clients when they make a payment. Doing so, your professional relations with them will bloom.

On festival days, their birthday, in a particular period of a month or year, provide them with some tempting offers and discounts, making them feel that they are more than just a way of making money for you, a human being you take care of.

This way, you can retain them longer, thus the management of your cash flow will be smooth and free from obstacles.

Let’s Conclude All:

In this article, we told you why is cash flow important for your business, and its mismanagement and dearth can lead to the failure of your business. All was made clear to you with some stats keeping your interpretation in mind.

Furthermore, we also told you how to keep your cash flow in an ideal state. Adopting an advanced cash flow software or an invoice system like Invoicera with AR & AP management can ease your cash flow management.

So, having read all this, you need to pay heed to the fact that when you find anything abnormal in your cash flow, don’t hesitate to conduct a meeting, ask for advice and guidance from professionals, and the like to maintain it.

Also Read: https://www.xebi.com/business-services/top-10-business-intelligence-tools