Are you looking for tips to manage your business finance? Do you need expert guidance on how to manage small business finances?

Managing finance activity is an absolute need for any company- big or small. We all know managing business finances is a little bit tricky. However, we are not living in the 90s where Internet access was difficult. Nowadays accessing the Internet is as simple as a cherry on the cake.

If you are struggling with finances in business or searching for the answer to the above questions. This blog is meant for you, today I am going to discuss every aspect of small business financial management. So quickly grab a notebook and note down the important point. For all my readers, I will break down everything you must know about business finance.

Highlights of Contents

What is Business Finance?

Business Finances involves all the activities that are related to the purchase, income, investment, and saving of funds. In a short meeting the businesses’ economic needs.

Whether you are running a small business or a big firm, good financial management can double your chances of success. In the industry, an effective idea of managing your own business can do wonders.

There is a basic difference between a successful enterprise and a failure one. The successful ones know what is dumping your resources and what brings them up.

Why It is Important for Big/ Small Businesses to Manage Their Business Finances?

Before I give my views on the importance of business finances, I would like to ask a few questions.

If you are the finance manager, how you are making optimum utilization of cash to make the business profitable? How you are dealing with daily financial decisions?

I know this would be tough for you when your boss asks similar questions. But let me tell you if you have proper financial planning to show, you win!. And, to get this you need expert guidance like business consultants.

Well!, we are known with the term ‘Business Finance’, now let us learn its importance.

Importance of ‘Business Finance’ in Depth

Fund or cash is a fundamental necessity for the foundation of any business. Whereas business finance is the capability of ours to manage the same. Also, finance in business guides you on how to operate your limited expenditures in the business wisely.

- The most important aspect of business finance lies in how properly we run our business without running out of cash.

- Further, it helps us secure our cash for future and long-term investments.

- It guides you to make shrewd and prudent decisions about cash flow.

From the established business to startup, everyone needs open arm tips on how to manage business finances. And particularly in this COVID 19 outbreak, the importance of business finance can be felt.

According to a U.S. Bank study, almost 82% of businesses have failed to set themself just because of cash flow problems. From the above facts and figures, you can easily understand how much it is essential to manage our business’s financial status.

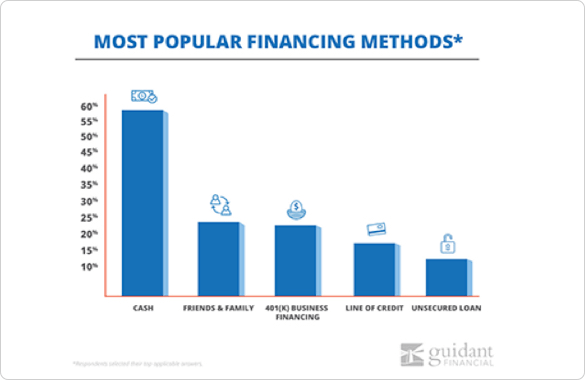

If still, you have any doubt, then take a look at the graph shown below.

Now let’s dive into how to manage small business finances? Or Financial management tips. I will give you significant financial advice tips that will knock business growth doors in the coming years.

5 Tips For Managing Business Finances

1. Purchase a Good Accounting Software

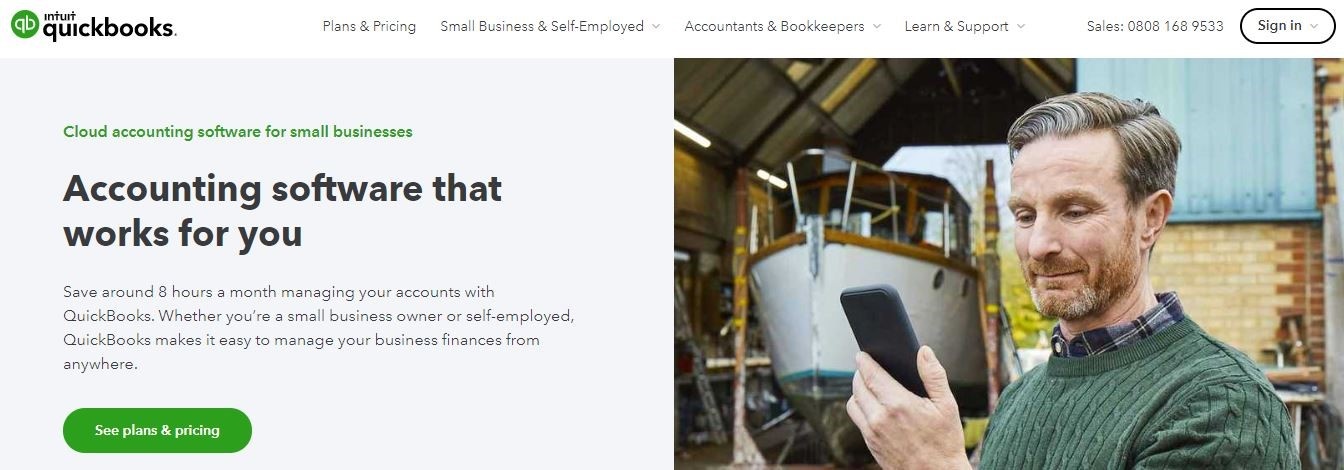

Purchasing a quality accounting software is the most important thing you can do for shaping business growth. Yes, bookkeeping software like Quickbooks, Freshbooks, etc can give you a variety of accounting solutions.

You can use such accounting software to track received and payable amounts. Calculate the profit, loss and even you can prepare yourself for tax season.

With the use of accounting software, a small business acquires extensive customizations in accounting. When your business starts growing its accounting will become more complex, so purchasing good accounting software is the right decision.

2. Manage Your Personal and Business Finances Separately

What if, you have mixed your personal and business finance together? These may put you in confusion because tracking the transactions made for personal use or professional use is tough.

Ultimately this will create more unnecessary complications. So, make sure you open a separate bank account for your business. This way you can easily measure your financial ins-n-outs.

At the same time, beneficial for tax purposes because you can easily sort down your transactions done every quarter or yearly. A separate account helps in easy monitoring of cash flow, profits, loss, revenues, expenses, etc.

3. Improve billing strategy

Each entrepreneur has a customer that reliably delays its payments and invoices. Overseeing private company funds additionally implies overseeing income to guarantee your business is working at a sound level on an everyday premise.

In case you’re battling to gather from specific clients or customers, it’s better to improve your billing strategy. This might take time but effective to take off from nightmares.

Billing is an important part of the business. This is a reason why business owners should grab an effective way for the invoicing system. Sit for a while and prepare a strategic plan where both you and your client agree with the payment term and conditions. Also, automate your billing system for faster payments.

4. Hire a Finance Professional

Several business giants tend to attempt everything by themselves. Be that as they are perfect do everything. But let me advise you, hire legal professionals for the bookkeeping. This part isn’t for the most part inside an entrepreneur’s wheelhouse.

In spite of the fact that it’s anything but difficult to imitate like an accountant. Working with a professional accountant can assist you with setting aside cash as time goes on. You’ll be opened up to deal with high-esteem tasks that keep the business pushing ahead, while your clerk handles the monotony of calculating.

5. Monitor and Assess Your Financial Position

Start checking your numbers consistently. At the point when steady, this positive and proactive practice is a consolation that you have more cash coming into your business than leaving it — or if this isn’t the situation, that you know why this is.

Focus on it to realize what amount is in your business account, the number of deals you’ve made that day, and, if proper, how much stock you hold.

These are all important for proficient bookkeeping rehearses named ‘income’ and ought to be embraced at an early stage in your business, making them natural as your business develops.

Dealing with your income is crucial both for your business endurance and its development. What’s more, to be successful, the circumstance of these costs needs to offset with your pay.

Keeping steady over late installments is additionally vital. Guarantee you have clear credit terms and conditions set up and that you issue clear and precise solicitations as fast as could reasonably be expected.

Let’s Wrap it Now!

All these are the potential benefits and the reasons that will take our business to the next level. Being an organization, you should have active and realistic ideas to grow. It would be better if you start concentrating with the business consulting company. They will guide you and show you the right way.

Frequently Asked Questions (FAQs)

Q1- How do I manage my business financially?

Ans– These are the best approach to manage business financially:

- Invest in quality bookkeeping software.

- Owe a good billing strategy.

- Separate explanation tax payments.

- Monitor your ins-n-outs in the business.

- Concentrate on investments, but also ROI.

- Plan ahead with healthy financial habits.

Q2- What should small businesses do to organize their finances?

Ans– Here are few tips to can carry out to organize your small business finances:

- It’s important to have analysis or have a report of investments(where you spend or from where you receive payments).

- Hold a separate Bank Account for your official works.

- Shield your business with security tools to protect your confidential data.

- Distribute hard copies and digitize them.

- Plan regular meetings with clients.

Q3- What should you do to manage your business growth?

Ans– You can carry out few things to keep your business fast-growing

- Employ the right crew.

- Monitor your financial activity regularly.

- Use the capital in the right place.

- Focus on your strengths.

- Satisfy your clients’ needs.