Artificial intelligence (AI) is the buzzword of today’s financial industry, with many people, especially the millennials jumping in to find their career path in this domain. It’s predicted that AI will be a mainstream technology for companies in 2021, with 86% of firms already expecting this trend to continue.

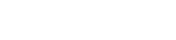

In 2021, artificial intelligence will create $2.9 trillion worth of value with 6 billion hours dedicated globally by 2030, according to Gartner Inc.’s report published this year!

Besides, according to a new survey from Stripe, nearly three-quarters of financial technology companies see artificial intelligence as the most remarkable change agent over the next five years.

Its latest industry report used data gathered through interviews with more than 120 executives in the global FinTech community, San Francisco. Stripe claims that AI will be “the next big platform” that every financial services company will need to integrate into its products and services.

The survey also found that two-thirds of the respondents believe AI has the potential to “greatly improve” or even “revolutionize” all areas of banking, from fraud prevention and automated investment advice to customer service and claims processing.

That means that the next five years will see a surge in AI-driven technology that promises to penetrate deeply into finance. So, let us go ahead by taking a look at some basic things.

Highlights of Contents

AI in Fintech: Why It Is Important?

AI is all about leveraging machine learning, deep learning, and natural language processing algorithms for building smart applications that can accomplish tasks with less human intervention. It has already demonstrated its potential in many industries, including fintech. While the benefits of AI are being highlighted, banks have also started to deploy this technology for tasks like face recognition in bank accounts, chatbots on financial websites, etc.

- It also allows banks to reduce their operating costs, which is especially important in struggling after years of non-stop investments.

- It can be used to transfer or invest your money across various financial products or services. For instance, you may not be required to visit banks every once in a while if your bank can place your savings and investments across other products and services via its chatbots.

- Besides, it can also be used to provide up-to-gigabyte solutions for your credit history or profile. Banks are now using machine learning algorithms based on social media activities to assess individuals’ creditworthiness.

- AI can even be used as a business growth strategy for banks, as they tend to give more weight to the relationships with their customers since that is what makes or breaks them. This is where AI comes into the picture to provide personalized experiences and targeted offers to customers based on their predicted needs and preferences.

These were few examples of how AI can be used for financial benefit. Now, let us see how AI will impact the Fintech Industry for the next five years?

10 Ways AI Is Going To Change Things For The Fintech Industry!

AI will likely change the way we do things forever, though it will take at least five years to feel its full impact. There are many predictions about AI’s role in the upcoming years, but some things are already evident. Tech companies are rushing to acquire AI startups and tech specialists as they try to figure out how best they can use this new technology to their advantage.

Here are some ways AI is expected to impact fintech in the next five years:

1) Reduce Fraud

Though fintech has multiplied in recent years, it’s still very much in its infancy. That means innovators and entrepreneurs have plenty of opportunities to introduce new ideas and services, especially around fraud reduction.

As one example, AI-driven tools are currently being developed that could one day be used to predict whether credit card repayment is based on behavioral patterns or a customer will default on a loan. The potential applications are pretty significant — and worth watching over the next five years.

2) Increase Customer Satisfaction

Improving customer satisfaction starts with understanding your customers’ pain points. With AI, financial institutions can understand their customers better than ever before, identifying common problems and working to solve them proactively.

By using AI, banks can offer targeted services that address specific pain points within each customer’s life — and keep them happy in return.

3) Enhance Security

Financial services are some of today’s most sought-after targets for hackers. To prevent data breaches and financial losses, you need to employ technology to maintain maximum security for your customers’ information. That’s where AI comes in. AI can enhance your current security measures by analyzing customer profiles and transactions to detect anomalies, flagging potential threats before they happen.

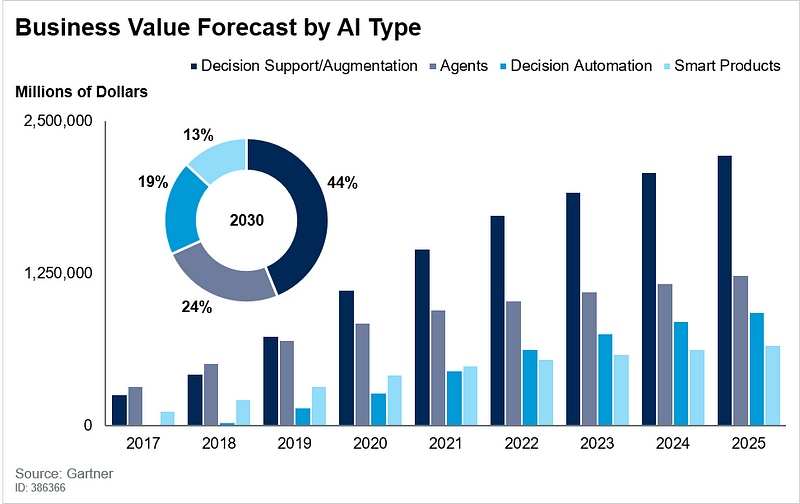

As an extra layer of defense, AI can even monitor your customer’s devices or locations when possible breaches occur. However, the Digital Banking Report 2020 shows that the adoption rates of fintech services in Canada and the United States are some of the lowest.

4) Streamline Operations

One of AI’s most exciting and immediate benefits to fintech professionals, like banking and credit, is its ability to enhance decision-making. Thus, an increasing number of banks are looking to incorporate artificial intelligence into their risk assessment processes; others are using it to make lending decisions more efficiently.

One particularly forward-thinking bank already employs an AI Concierge named Maggie that guides new clients through specific processes.

5) Enhance Decision Making

Artificial intelligence has already begun to augment existing fintech tools, like machine learning in fraud detection. Over time, AI will not only help detect fraud more accurately than ever before, but it will also enable fintech companies to tailor their services based on specific user preferences.

Customers who bank with certain institutions might find that they get automatic credit line increases or improved rates for accounts they frequently hold — all because of AI’s adaptive decision-making capabilities.

6) Improve Marketing Efforts

I don’t think it’s any secret that if your core product isn’t working, you need to find new ways to monetize your service. This may include working with other companies on new services or allowing them to piggyback off of your current platform.

Do some research on your niche and expand your product offerings as needed. If you can develop more features for less money, you would spend hiring additional staff.

Zest reports that AI pilots will save banks and other financial institutions money, with the operating expense (OPEX) being some of their most enormous benefits.

7) Expand Product Offerings

One of AI’s most significant impacts on fintech will be helping financial services firms expand their product offerings to customers. Companies are often limited by what they offer based on demand, costs, and regulatory constraints.

Financial services firms that use AI will have greater flexibility in determining how much or how little to produce, allowing them to sell more products at different price points.

8) Automate Data Collection

Artificial intelligence, or AI, is beginning to infiltrate fintech thanks to a new generation of software programs & tools that use machine learning and natural language processing algorithms. By leveraging AI, fintech companies can take advantage of customized processes and repeatable activities.

For example, AI can automatically route transactions based on a customer’s spending habits, or it could automatically generate personalized letters from a financial advisor using the information provided by customers. In either case, processes are being made more efficient thanks to artificial intelligence.

9) Boost Efficiency by Standardizing Processes

Robots and machines will do most of our messy work in years to come, which means we will continue to spend more time working on creative and innovative projects. This could make it possible for us to create new business models; when we don’t have to spend our days doing menial tasks like filling out forms or running reports, we can spare more time thinking about adding value in creative ways.

10) Empower Employees

Artificial intelligence can take business processes previously handled by employees and allow them to handle higher-level tasks. This will empower employees to focus on their strengths and enable AI-driven solutions to take over their daily tasks. This reduces workloads and increases employee satisfaction.

Conclusion

We’ve already begun to see AI in action in financial services. Banks and other financial institutions are using it to improve customer service and streamline their business processes. But we can expect to see many more advances in AI over time, with more giant corporations and governments taking up the challenge of integrating sophisticated algorithms into their services.

Financial institutions need to stay on top of these changes to stay competitive in a rapidly changing marketplace. At the same time, at-home users will benefit from a more effortless user experience through more automated tools.