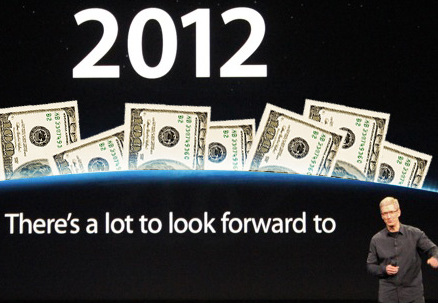

Apple Inc, one of the most regarded company in the world, is ready to come face to face with one of its biggest challenge ever faced in corporate America – How does it plans to utilize the $98 billion cash hoard?

Just after a few days since the stocks of Apple Inc touched $600, it issued a short press advisory informing that a press conference would be held on Monday, with the purpose of discussing the result of discussions regarding its cash balances. The recent move has been a result of massive outcry of the investors who have asked the company to return some share of the money to its shareholders.

If the ISD Group Analyst, Brian Marshall is to be believed, than the cash and securities of the manufacturer of iPhone, iPad and iPod are as high as $98 billion, which is equal to $104 a share.

Wall Street has always, quite vociferously suggested that Apple will return the cash to its shareholder, this year. The comment of Tim Cook, Chief Executive of Apple, regarding the “active discussions” has particularly led the Wall Street to predict the same.

Recently, Tim Cook revealed that he had been “think very deeply“ regarding the demands of its investors from Apple to return some of the money to shareholder by the means of the dividend.

During the annual shareholder’s meeting, held in February, Tim Cook confessed the same. He said “Frankly speaking, it’s more than we need to run the company.”

Analysts believe that the return in terms of cash to shareholders may take the form of either an annual payout, or a one time dividend. The same will open the company to a complete class of investors who are looking out for a dividend yield. Another alternative that remains with Apple Inc is to offer a share buyback.

“A dividend makes sense,” said Shaw Wu, analyst with Sterne Agee. The decision “is probably going to be pretty binary. It’s going to be either yes or no. Many are hoping the answer is going to be yes.

“It’s more likely they are considering it. I am not sure they are going to necessarily say it’s to be effective immediately.”

Wu believes that the value of shareholder in terms of a stock buyback is much more objectionable. “The issue with (a) buyback is that the payback for investors is not as tangible. With a dividend, you get a check in the mail.”

Wu also raised doubts on the stock split, saying that it would be much more a problematic task for the Apple to beat the earning forecasts, predicted by the consensus.

The trend is signaling more towards the option of a buyback. Along side, the sale of the newest released iPad is expected to keep the tide in the favor of Apple Inc, and the same may propel the stock to a record high of $600 per share.

As per the closing price on Friday, which was for $585.57 Apple, its market value is projected to be around $546 billion.

Marshall, from the ISI said that a dividend would attract much more stock purchases, especially from the top 20 dividend mutual funds along with other investors, and subsequently Apple would gain the status of being a top holding company. Also he added that Apple has the capability of paying an annual dividend of $14.65 per share.

According to the company, the Apple Call which is slated to be held at 9 a.m. EDT (1300 GMT) on Monday, will have nothing to do with the current quarter, nor will it deal with any topic, other than the cash, as per the statement released by the company on Sunday. Apple Inc refrained from commenting further about the same.