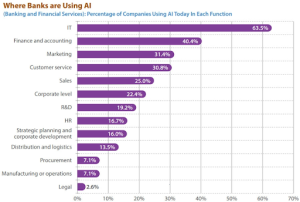

With the evolution of technology, the banking sector is now being propelled by Artificial Intelligence (AI). This AI is transforming how banks communicate with their customers, offering better services and more convenient ways for customers to access their accounts, transfer money and make payments.

In this blog post, we will explain 11 different ways that AI is revolutionizing the banking sector, improving the customer experience significantly.

1) Make customer service more efficient

Customer interaction with banks has gone through a radical shift over the years, and the integration of artificial intelligence (AI) is reinventing the way customer service is handled in the banking sector.

AI can be leveraged to carry out routine activities like answering customer queries, executing payments, and verifying account details, thereby providing customer service representatives with additional time to focus on more complicated jobs. AI can also help enhance customer service by providing custom-tailored recommendations based on individual customer requirements.

For example, AI-powered chatbots can answer customer queries promptly and precisely, assisting customers in getting the information they need more quickly. Moreover, AI can yield insights about customer conduct and preferences, enabling banks to customize their services to fulfill customers’ needs better. AI thus provides businesses with the opportunity to provide a more personalized and streamlined experience for their customers.

2) Help banks detect and prevent fraud

With advancing technology, the tactics used by fraudsters are also developing. Consequently, banks are turning to Artificial Intelligence (AI) to help detect and avoid these criminal acts. AI-driven algorithms allow for more comprehensive customer data analysis, helping to spot suspicious activity that may be fraud.

Furthermore, AI is being employed to survey accounts for potential signs of illegal behavior, like quick movement of a large sum of money across accounts or many failed login attempts from the same IP address. By implementing AI-based approaches, banks can protect their customers’ funds more quickly and thoroughly, building trust and customer satisfaction. AI can also streamline compliance measures, so that businesses have the capacity to provide higher quality services.

Moreover, using AI-driven technology such as facial and voice recognition, customers have an extra level of protection when using accounts online or doing transactions. This provides comfort for customers and helps instill faith in banking services, as well as providing convenience as individuals do not need to remember complicated passwords or answer security queries. Lastly, AI-powered chatbots deliver instant responses to customers’ questions and allow banks to swiftly respond to concerns, with no need to recruit additional personnel.

3) Help customers manage their finances better

Financial management can be a difficult endeavor, yet Artificial Intelligence (AI) has the potential to help customers navigate it more effectively. Through AI-based apps, customers can monitor and establish financial goals, analyze their spending habits, and even craft customized budgets.

With predictive analytics, AI can forecast customers’ future financial needs and aid in making decisions accordingly. Additionally, AI-driven tools can offer tailored advice to help customers reach their monetary objectives. In the end, AI empowers customers to take command of their finances and make informed decisions.

4) Make banking more accessible to everyone

For many, the process of banking can be intimidating, especially for those unfamiliar with financial services or who do not have a standard banking account. AI offers a way to make banking more attainable, offering a customized experience based on the individual’s specific needs.

Chatbots, for example, are enabled by AI and offer customers rapid answers to simple questions, in addition to providing beneficial guidance. AI also enables banks to offer self-service options like mobile banking, enabling customers to easily connect with their accounts anytime, anywhere. Additionally, AI helps banks reach out to previously underserved communities, granting them secure banking options without the necessity for a traditional bank branch.

5) Help banks personalize the customer experience

Artificial Intelligence (AI) is transforming the banking sector in a number of ways, most notably in the realm of personalizing customer experience. AI-powered technologies are able to provide individualized services, notifications, advice and recommendations to customers based on their unique needs and preferences.

For instance, AI-driven chatbots can be utilized to provide personalized counsel to customers by posing pertinent questions about their financial standing and subsequently suggesting custom-made solutions. Analytics powered by AI can likewise be employed to review customer data to better comprehend their spending habits and explore opportunities for offering further personalized services.

This approach can significantly bolster customer engagement and satisfaction by presenting customers with tailor-made advice, notifications, alerts and product recommendations. AI-driven tools are also able to monitor customer feedback and advise on potential improvements and enhancements to existing products. With an enhanced understanding of customer demands, banks can better curate and provide services to customers that suit their specific needs, leading to improved customer satisfaction and increased loyalty.

AI technology is capable of helping banks enhance customer experience through its capacity to comprehend individual customer needs and deliver more tailored services. Through leveraging AI-powered technologies, banks can offer more customized, rewarding experiences to their customers, thereby achieving higher customer satisfaction and retention.

6) Make banking more convenient

The banking sector is in the midst of a digital revolution and AI is at the forefront. It has the potential to make financial processes quicker, easier, and more convenient for customers. For example, the utilization of AI-driven technology such as chatbots allow banks to give around-the-clock customer service, respond to inquiries, take care of issues, and support customers in their banking activities.

AI also enables banks to give automated payments, personalized notifications, and up-to-the-minute information on account balances, transactions, and other fiscal matters, making it easier for clients to stay on top of their finances, maintain their accounts, and execute banking tasks on the go. Moreover, AI-empowered voice recognition technology helps banks provide secure vocal authentication so that customers can sign in to their accounts without having to remember several passwords or PINs.

Furthermore, AI facilitates a simplified and automated onboarding process for customers opening and managing new accounts, by streamlining the application forms. These advances make banking more convenient and available than ever. AI is also making it easier for banks to recognize and tackle fraud in a more accurate and timely fashion.

Machine learning algorithms which are driven by AI are able to analyze information from transactions and distinguish patterns which indicate potential fraudulent activity. This helps to avoid fraudulent occurrences and if they do take place, they can be quickly detected. In addition, AI can generate knowledge from customer data to aid banks in understanding their customer base better and modifying their products, services, and experiences to match their clients’ needs. This allows banks to give a higher quality of service and a more rewarding customer experience.

AI-powered virtual advisors enable banks to engage in conversations with customers regarding their banking needs and give personal recommendations based on past behavior and preferences. These advisors are always accessible, giving clients personalized assistance any time they require it.

7) Help banks target marketing efforts more effectively

Through Artificial Intelligence (AI) banking, businesses can refine their marketing approaches, achieve greater insight into client tastes, and boost efficacy. AI can survey customer information to determine the most suitable market for each service or product, enabling organizations to create campaigns more aligned with individual needs. Furthermore, AI helps to gain more precise information about customer habits, which in turn assists with optimizing marketing plans. Leveraging AI makes it possible to deliver the most suitable message to the ideal audience at the optimal time.

You should hire iOS developers in India for AI based software solutions as it supports businesses to assess and monitor the performance of their campaigns. With customer response data to advertisements, AI can show which messages are resonating with the desired clientele, and which need improvement or substitution. AI can also supply insight into how clients feel about the company’s brand and products or services, empowering businesses to modify their strategies in line with the feedback.

AI provides detailed data about customers’ behavior and tastes, which aids in refining and streamlining marketing efforts. Companies can optimize their campaigns and evaluate the outcomes more accurately through AI, resulting in time and money savings, as well as enhanced personalized customer experiences.

8) Improve risk management for banks

As banking systems become ever more intricate and variable, the aptitude of banks to precisely evaluate and regulate risk is of paramount importance. Artificial Intelligence (AI) can be applied to aid banks in comprehending customer data more effectively and distinguishing potential areas of risk in real-time. AI-driven analytics can aid banks in discerning customer conduct that could allude to potential fraudulent behavior or credit risks. Furthermore, AI can assist in foreseeing forthcoming financial movements, allowing banks to make judicious decisions regarding prospective investments and loan strategies.

You can hire android app developers in India for AI-supported risk management systems, as it can help banks to analyze customer data and discover significant indicators for possible risks. AI-driven analytics can track customer habits, transaction models, and market tendencies to identify any impending dangers before they become a problem. Through these developed analytics, banks can spot oddities in customer activities promptly and readjust their rules accordingly.

Moreover, AI can be used to enhance the potency of current procedures and products. For example, AI-based systems can analyze customer portfolios to find investments with a high risk factor and suggest strategies to reduce such risks. By utilizing AI-driven analytics, banks can also enhance their overall portfolio execution by making shrewd decisions.

AI can help banks make more enlightened decisions with respect to risk management. By deploying predictive analytics and machine learning algorithms, banks can more effectively pinpoint, follow up on, and mitigate areas of risk in real-time. This advanced level of risk management will not only benefit banks, but also secure customers from potential losses.

9) Help banks meet regulatory requirements more easily

Regulations are becoming more complex, leading governments to introduce stricter banking standards. To keep up with the ever-evolving landscape, business owners are turning to Artificial Intelligence (AI) for support. AI provides banks with real-time surveillance, evaluations, and automated risk management tools that can detect any potential threats before they occur. Moreover, AI enables companies to stay in compliance with changing laws, quickly responding to regulatory shifts.

When you hire mobile app developers in India for AI-driven solutions, you can simplify the tedious paperwork required for compliance. AI processes data quickly and accurately, cutting down on human error. This advanced technology also speeds up the customer onboarding process, providing a smooth, streamlined experience.

AI is also proving to be an invaluable asset in banking, facilitating regulatory compliance while elevating the customer experience. With its capacity to automate and optimize procedures, AI is likely to transform the industry in the near future.

10) AI can make financial advice more objective

The current banking environment makes it difficult to deliver impartial financial guidance to clients. Fortunately, AI technology can help with this endeavor by quickly and accurately examining customers’ data to produce personalized advice.

Banks are further able to implement automated financial advice to grant clients the necessary support they need quickly and with no need for a human representative. By implementing AI-driven financial advice, banks can make sure that their customers receive the optimal advice tailored to their unique situations.

11) AI can help banks become more sustainable

Banks are continually looking for methods to advance their sustainability goals and lessen their ecological impact. Artificial Intelligence (AI) can be a powerful instrument to help banks accomplish this ambition. AI technology can be used to discover possibilities for improvement, to perfect operations, and to optimize efficiency. For example, AI can be used to discover chances for superior resource administration and more effective energy usage. It can also assist banks in studying customer data to make more intelligent decisions that will decrease wastefulness and enhance efficacy.

AI can also be employed to assist banks to become more sustainable by identifying areas of vulnerability and probable difficulties before they occur. Banks can use AI to supervise market trends and to identify warning signs of market vacillation or alterations in the economy that could affect their processes. By monitoring these circumstances, banks can take proactive steps to curtail risks before they appear, eventually leading to a greater level of sustainability and profitability.

Furthermore, AI can aid banks in their goal of sustainability by helping them locate areas where costs can be lowered. AI-driven technologies such as automation and predictive analytics can assist banks in making more astute decisions regarding expenditures and resource management. This will enable banks to cut back their operational costs while still giving their customers the same level of service they anticipate.

AI is a significant resource that banks can use to become more sustainable. With AI, banks can detect regions of risk and possible issues more precisely, optimize resource management, and lower operational costs. By making use of AI and hiring Indian AI developers, banks can upgrade their sustainability plans and lessen their ecological effect.

Conclusion

Artificial intelligence is quickly becoming an integral part of the banking industry, revolutionizing how banks interact with customers and provide services. By leveraging AI technology, banks can more effectively prevent fraud, manage risk, provide personalized experiences, and meet regulatory requirements.

AI also helps banks become more sustainable by providing objective financial advice and making banking more accessible to everyone. With the help of AI, banks can make customer service more efficient, convenient, and personalized, resulting in a better customer experience overall. Hiring Indian mobile app developers can help your bank leverage the power of AI and stay ahead of the competition. By integrating AI into their banking systems, banks can ensure that their customers have the best possible experience when it comes to banking.

Frequently Asked Questions

1) How does Artificial Intelligence (AI) improve customer service?

AI can help banks provide faster, more accurate customer service by automating simple tasks and providing intelligent customer support. AI-powered virtual agents are able to understand customer queries and provide personalized, helpful answers.

2) How does AI help banks detect and prevent fraud?

AI can help banks detect fraudulent activity quickly and accurately by analyzing large amounts of data and spotting anomalies. AI-powered systems are able to identify suspicious behavior, such as transactions with unusual patterns, and alert the bank of potential fraud.

3) What kind of financial advice can AI provide?

AI can provide customers with personalized financial advice, tailored to their individual needs. AI-powered systems are able to analyze a customer’s financial situation and provide recommendations on how to best manage their money.

4) How does AI make banking more accessible?

AI can make banking more accessible by providing customers with easier, more convenient ways to manage their finances. AI-powered services such as mobile banking apps can enable customers to access their accounts anytime, anywhere.

5) How does AI personalize the customer experience?

AI can help banks provide customers with more personalized experiences by analyzing their behavior and preferences. AI-powered systems are able to customize services based on customer needs and provide them with relevant, helpful recommendations.

6) How does AI improve risk management for banks?

AI can help banks manage risk more effectively by analyzing large amounts of data and identifying potential threats. AI-powered systems are able to spot patterns in customer data that may indicate financial instability or other risks, helping banks to take preventive measures.

7) How does AI help banks meet regulatory requirements?

AI can help banks comply with regulatory requirements by automating compliance processes and alerting the bank when there are any potential issues. AI-powered systems can also help banks detect potential fraud or money laundering activities, enabling them to take appropriate action before it is too late.

8) How can I make banks more sustainable?

AI can help banks become more sustainable by improving operational efficiency and reducing waste. AI-powered systems are able to automate tedious tasks and optimize operations, allowing banks to become more cost-efficient and reduce their environmental footprint.